Creating a Balanced Real Estate Investment Strategy

Finding balance is one of the hardest things to do when embarking on a new experience. With so much excitement around the newfound knowledge and journey to come, it can be easy to get tunnel vision. A balanced real estate investment strategy diversifies risk and maximizes returns while aligning with the investor's goals, risk tolerance, timeline, and lifestyle.

Before investing anything, one should always start with the end in mind. Take the time to identify your goals and motivations, this is extremely important because your "why" will help define your risk tolerance. Plan what you want the next 5-10 years of your life to look like, and then create financial benchmarks that will get you there. Then, with the end in mind, determine how you want to allocate your capital, things like retirement accounts, stock market brokerage accounts, etc. are all great ways to invest outside of real estate and should be a part of your overarching financial plan. Once you have an idea of how your financial investment strategy will look, you will be ready to focus on the real estate aspect of your plan. Even still, it will be important to make sure that you develop a balanced investment strategy within the asset class. Here are a few things to consider when creating an investment strategy for the real estate asset class!

- Diversification Across Property Types

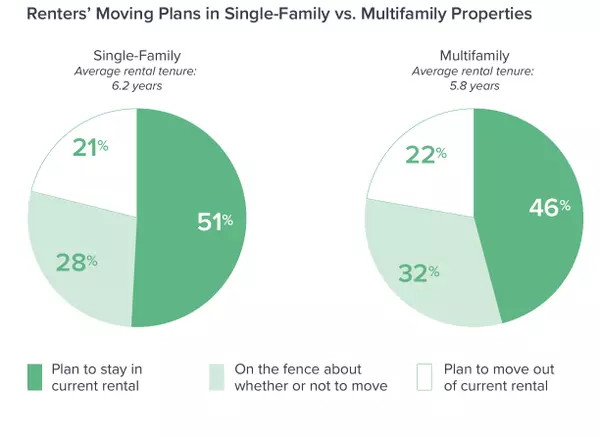

- A balanced portfolio would include a mix of property types; such as single-family homes, multi-family units, and even commercial mixed-use space or industrial space. This diversification will help protect against the risk associated with fluctuating market trends and tenant vacancies.

- Active & Passive Investments

- Active investments like Airbnb or House Flipping can offer higher returns, but require a larger time commitment and entail more risk. On the other hand passive investments, like real estate investment trusts, and investing in rental properties can provide monthly cash flow with less risk exposure and less day-to-day attention. Deciding which path to pursue will be key in establishing a real estate investment strategy.

- Portfolio Management

- Who will manage your portfolio? Will you be hands-on? Will you hire a property management company? Great questions to ask when developing your strategy.

- Risk Management

- A balanced strategy ALWAYS involves understanding and managing risks. Understanding market trends, and being prepared for unexpected expenses and unexpected economic shifts, make having contingency plans in place crucial. Avoid being over-leveraged and make sure that the portfolio is self-sustaining.

- Leverage and cash holdings

- Using Leverage can be an awesome tool that helps investors quickly scale a real estate portfolio. During underwriting, mortgage lenders can take the potential future earnings of an investment property and apply it to the debt-to-income ratio of an investor. This is awesome because it allows investors to obtain loans they would otherwise not qualify for. It also can create an environment that allows investors to quickly become over-leveraged…. So it is key to make sure that the revenue of your portfolio drastically outpaces its expenses and debt obligation. A balanced strategy would include a mix of leveraged properties and those owned outright. Maintaining some liquidity through cash reserves will create an ideal safety net.

- Exit strategies

- Having clear exit strategies for different investments can ensure that you can make the proper decisions when it's time to sell or move on. This requires an understanding of market timing, tax implications, and how each sale fits into the broader investment goals. It might involve selling underperforming properties, rebalancing the types of properties held, or adjusting strategies based on new information.

Real Estate, like any other asset, is an investment. Implementing an effective strategy will 10X your results and provide peace of mind. An effective strategy helps investors stay on track and avoid distractions that could alter their risk profile or jeopardize current equity. If we can help you come up with a strategy that suits your lifestyle don’t hesitate to contact me, we are here to help!

-Cameron Gunnels

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "