Mortgage Rate Trends in 2024: Expert Insights and Predictions

Recent Trends and Current Rates:

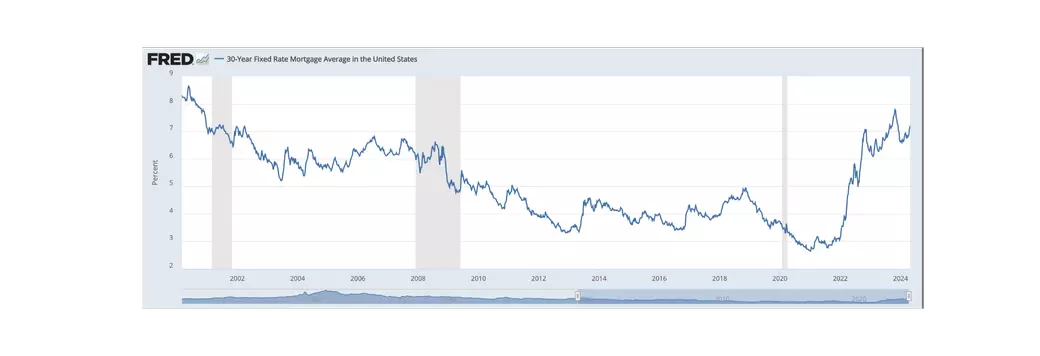

The year has witnessed fluctuating mortgage rates, with a notable decline from the peaks of late 2023. According to Freddie Mac, the average 30-year mortgage rate has decreased from a high of 7.79% to around 6.93%. This slight relief comes after aggressive hikes by the Federal Reserve in response to rising inflation in 2022 when we saw mortgage rates reaching a 20-year high.

Expert Predictions for 2024:

Looking ahead, experts from various financial institutions have weighed in on the potential direction of mortgage rates for the remainder of 2024:

- Mortgage Bankers Association and Fannie Mae both forecast that rates could stabilize around 6.4%, slightly adjusting their earlier predictions in response to current economic indicators.

- Realtor.com and Redfin predict a slightly higher stabilization at around 6.5%.

Taking a Deeper Dive on "Expert Projections"

These projections hinge largely on economic data releases and Federal Reserve policies aimed at controlling inflation without stalling economic growth.

One thing to consider when reading “expert predictions” like these is that the experts are pulling information from commentary that the Federal Reserve releases. The role of the Federal Reserve is to manipulate customer spending in a way that encourages economic sustainability, longevity, and growth. Therefore, if the plan is for if rates to keep increasing, would it be smart for the Federal Reserve to tell us? If the Federal Reserve told the public that interest rates will continue to rise for the next 5 years, all consumers would rush into the market to buy before rates get too high. Which would perpetuate the larger issue of inflation, and continue the cycle of a high-rate, high-price environment.

To truly slow inflation consumers need to stop buying, which means they need to believe that there will be a better deal / lower costs in the future. So, it could be possible that the Federal Reserve is also playing psychological games, by using the incentive of lower rates in the future to keep consumers out of the market, thus slowing inflation and forcing prices down.

Just something to think about when reading things like this.

Factors Influencing Future Rates:

Several key factors will influence mortgage rates in the upcoming months:

- Federal Reserve Policies: The Fed's decisions on interest rates are crucial. While they have hinted at potential rate cuts later in the year, recent upticks in inflation might delay these cuts, maintaining upward pressure on mortgage rates.

- Economic Indicators: Reports on employment and consumer prices will play a significant role. A cooler inflation rate could lead to reduced mortgage rates, while unexpected spikes might halt or reverse the downward trend.

What This Means for Buyers, Sellers, and Renters:

Buyers:

Those looking to purchase homes might find slightly lower rates beneficial, but the decrease may not be significant enough to dramatically improve affordability, especially with ongoing high home prices and insurance costs. Buyers should consider higher down payments. They should also be mindful of the possibility of refinancing in the future at a lower rate and focus on buying homes as long-term investments. Going into it with a long-term mindset will help add perspective if they are unsatisfied with their mortgage rate.

Sellers

With a high-interest environment and a limited buyer pool, it would be natural to assume that this will cause sellers to be more reasonable with sale prices. Consider though, if a seller sells their home at a lower price to attract more buyers, where would the seller move? It becomes a question of. Is this a first-time home buyer market? Or a returning home buyer market? If there are more first-time home buyers who can’t afford a home than returning home buyers who need to sell their current house at a high price to buy a second house, then prices will come down.

Additionally, sellers should be aware of the Importance of hiring a good listing agent. In a confusing market like today, the role of a realtor is crucial on both the buying and selling side. As a seller, your agent should encourage you to capitalize on all the advantages you can (season, staging, etc.).

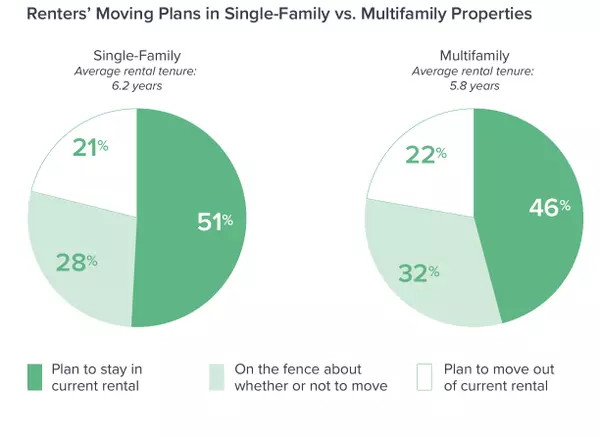

Renters

- Even as a renter, you should pay attention to mortgage rates, as rates increase so will the mortgage of the property owner, therefore your rent will increase accordingly.

Stay Updated:

For those interested in staying updated on mortgage rates and real estate market trends, bookmark this blog and check back regularly for fresh insights and detailed analyses. Whether you're planning to buy, sell, or refinance, staying informed will help you make the best financial decisions in a changing market.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "