2021 Market Review & 2022 Market Outlook

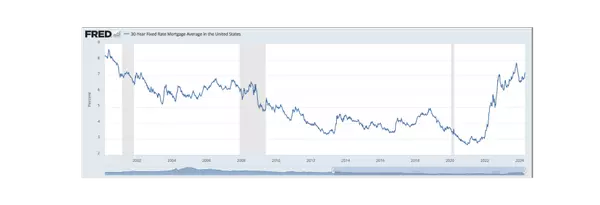

How Increasing mortgage rates are impacting the real estate market.

5/5/22

Increasing mortgage rates have led to a slow, but steady decline in demand for homes. According to NAR Research, the volume of home sales in January was 16% above the historical average. In February home sales were 11% percent above the historical average, and in March they were 8% above the historical average. Although we are still a great deal above the historical averages, it is evident that less homes are being sold every month, which indicates a slowing demand.

(4/21/2022) marked the 7th straight week of increasing mortgage rates, as they jumped from 5.0 to 5.1. At the time of writing this on 5/5/2022 rates have increased even further to 5.27. While the chances are that rates will continue to rise for the foreseeable future, for the time being this is still a seller’s market. In March the average sales price across Ohio reached 247,123 dollars, an increase of 11.1% from the average sales price during March of 2021. Prices are still increasing but we are noticing that their month-to-month rate of growth is dramatically slowing. Which suggests that the market is cooling down as a direct result of increased mortgage rates. It is important to note though, that although the market is cooling down, increasing mortgage rates combined with steady and/or increasing home prices makes housing less affordable and makes it more difficult to qualify for the home of your choice.

If you are local, you can contact me at cameron@gunnelsrealty.com, we can discuss your goals and set up a free customized home search to get you started on the path of homeownership.

-Cameron Gunnels

Categories

Recent Posts

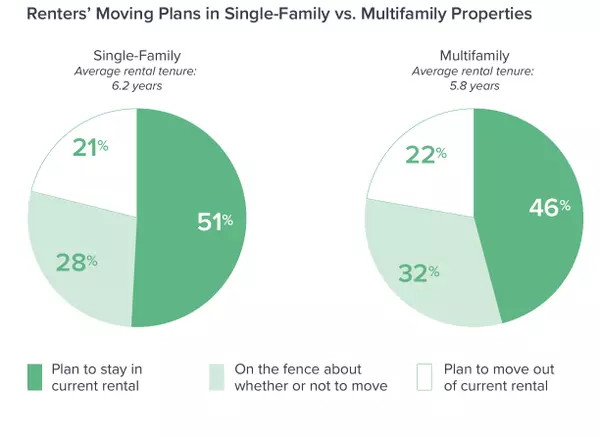

2024 Buildium Renters Report

Why Hire a Property Manager? Understanding the Benefits and Considerations.

2025 Market Outlook

2024 Recap

The Effect of Out-of-State Investors

What Happens When Rates Drop?

Mortgage Rate Trends in 2024: Expert Insights and Predictions

NAR Settlement (Fact vs Fiction)

First Steps for a First-Time Home Buyer:

2023 Real Estate Market Recap

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "