The Effect of Out-of-State Investors

Since 2020, national median home prices have increased nearly 25% most notably in coastal states. This sudden price increase has created an environment that is not conducive to small multifamily and single-family real estate investors. Because of rising prices, investors are finding it increasingly difficult to locate high-ROI investment properties.

While the rest of the country endured surging real estate prices, the Midwest market also expanded, but at a fraction of the pace. As a result, it became a prime target for investors seeking high returns. The Cincinnati real estate market, in particular, has seen a notable influx of out-of-state investors. According to the Cincinnati Area Board of Realtors, nearly 30% of home purchases in 2023 were made by buyers from outside Ohio, with many coming from states like California, New York, and Texas. This trend is reshaping the local landscape, driving up competition, and influencing home prices.

How Does This Affect Our Local Market & What Does This Mean For Local Investors?

To put it simply, it means more competition. Now, not only are local investors and home buyers competing with fellow Cincinnatians, but they are also competing with investors from across the country. Both Individual investors and large institutional investors. This newfound competition makes it harder for local citizens to obtain homes and investment property in their own city. Oftentimes out-of-state investors are willing to pay well above market value to secure a property, subsequently outbidding and freezing out local buyers. In 2022 one out of every six properties sold were purchased by a corporation. Additionally, in Cincinnati, 95% of Hamilton County is zoned for single-family homes, but the County only has an owner-occupancy rate of 39%. This means that 56% of these homes are rentals, likely owned by a corporation, possibly an out-of-state corporation. This raises the question: how much of our city do we actually own?

The arrival of these new investors also has an impact on prices. Data from the Cincinnati Area Board of Realtors shows that median home prices have risen by 15% year-over-year, partly fueled by this increased demand. This surge in prices makes it challenging for local investors and homebuyers, who find themselves competing in bidding wars against financially robust out-of-state buyers. This can limit opportunities for locals to invest in their communities, potentially altering the demographic and economic landscape. Increased demand leads to a faster turnaround in sales, decreasing the market's inventory and leaving little room for negotiation. As a result, local investors are finding it increasingly difficult to find deals that meet their investment criteria.

What can we do?

To combat this we can become more active in our own market.

The Case for Buying Now

For local investors, the message is clear: the time to act is now. Waiting on the sidelines could mean getting priced out of the market as property values continue to climb. Investing now is not just about securing a financial asset but also about having a stake in the community's development and reaping the long-term benefits of Cincinnati's growth.

- Historical Growth Trends: Looking at the historical data, Cincinnati's property values have consistently appreciated over the past decade. Investing now means tapping into this upward trajectory before prices escalate further.

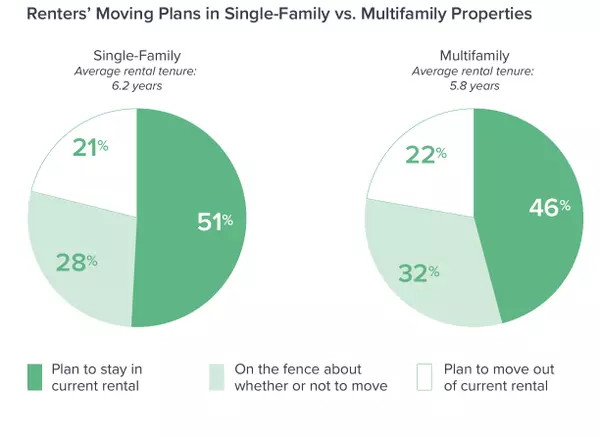

- Rental Market Strength: Cincinnati's strong rental market presents another compelling reason for locals to invest. With a growing population and increasing rental demand, property owners can benefit from steady rental income, which can offset the higher purchase prices.

- Community Impact: Local investors have a unique opportunity to shape the development of their neighborhoods. By investing in local properties, they contribute to community stability and vitality, fostering a sense of ownership and pride in their areas.

Local government officials and community organizations are also taking note of these trends and exploring solutions to mitigate the impact of out-of-state investors. Proposed measures include:

- Stricter Regulations: Some city leaders are advocating for regulations that limit the number of properties that investors can purchase in a given area, aiming to maintain affordable housing options for residents.

- Support for First-Time Buyers: Programs to assist first-time homebuyers, such as down payment assistance and educational workshops, are being introduced to help locals navigate the competitive market.

- Community Engagement: Engaging with residents to understand their concerns and aspirations is crucial. Neighborhood associations are organizing forums to discuss the implications of increased investment and potential strategies for sustainable growth.

Conclusion

The influx of out-of-state investors into Cincinnati's real estate market presents both challenges and opportunities for local buyers and investors. While competition is stiffer and prices higher, the potential for growth and community impact makes a compelling case for investing now. By understanding market dynamics and acting decisively, local investors can secure valuable assets and contribute positively to their community's future.

Categories

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "