How Much $ Do I Need?

If you think you need an enormous amount of cash to become the owner of an investment property, you are wrong. I did it for 12K.

For those who have never purchased real estate, and whose names are not currently on a mortgage. You are considered a "First Time Home Buyer!" Which means that you qualify for special programs and grants that current homeowners & investors do not.

One of these special allowances for new home owners is the ability to qualify for an FHA "First Time Home Buyer" loan. With this specific loan package, the required down payment (up front cost) is only 3.5% of the total purchase price! To put this into perspective, typically an investment property requires an initial down payment of 20-30%. By taking advantage of your status as a first time home purchaser you could save upwards of 17% out of pocket costs.

There is a minor caveat though. The 3.5% down payment option is only applicable for primary residences. Meaning the buyer must live in the property for a specified amount of time. With that being said there are no rules that dictate the type of structure. Therefore this type of loan can also be used to purchase 1-4 unit rental property, as long as one of the units will be occupied by the potential buyer (you).

Why Become a Rental Owner Early In Life?

The answer is in the numbers.

How much do you currently spend on rent?

-

$ 1,300

How expensive is the rental property you want to purchase?

-

$ 300,000

How much will the down payment be? (3.5%)

-

300,000 x .035 = $ 10,500

How many individual apartments are in the rental property?

-

4

What is the projected gross rental income per apartment?

-

$ 900

What is your projected monthly mortgage payment? (principal, interest, taxes, homeowners insurance and PMI) (Mortgage calculators can be found online):

-

$ 2,200

Using the above info calculate the properties monthly income after mortgage:

-

4 (units) x 900 (rent) = $ 3600 Then. 3,600 - 2,200 (mortgage) = $ 1,400

Now, since the new owner will be living in one of the apartments let's determine our monthly income using the rents from only 3 apartments:

-

3 x 900 = 2,700 then 2,700 - 2,200 = 500/month in income.

Aside from other expenses such as utilities and unforeseen occurrences the monthly income in this scenario is five-hundred dollars!

Imagine making an extra $500 per month living in your new investment property instead of spending $1,300 per month on rent....

Purchasing a rental property and using it as a primary residence allows you to live for free, and eliminate monthly housing expenses. This will accelerate your ability to save capital and provide monthly passive income.

So, how much money do I really need to purchase Real Estate?

-

Not much, and the proof is in the #numbers

For more detailed financing techniques, and an investors guide to creative deal structuring click here:

As always, I am available to help in any way I can! Cameron@gunnelsrealty.com

-Cameron Gunnels

Categories

Recent Posts

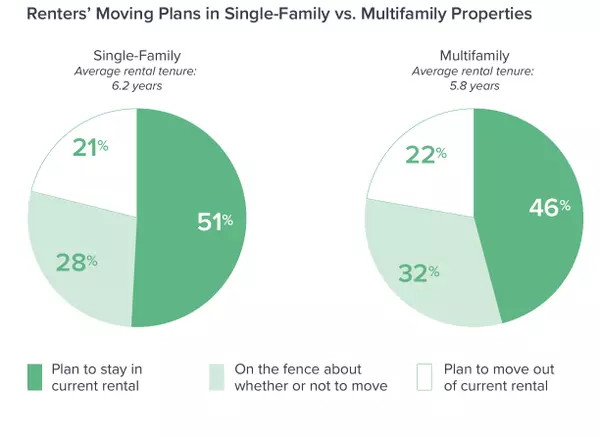

Landlords: The 2026 Rental Market Outlook

The 2026 Cincinnati Investment Market

Is it a Smart Time to Buy a Home in Cincinnati?

Should You Sell Your Cincinnati Home in a Higher-Interest-Rate Market? A Data-Driven Look at 2025 & 2026

Cincinnati Residential Real Estate Market Report (2025 Review + 2026 Outlook)

Market Trends (2025-2026)

2024 Buildium Renters Report

Why Hire a Property Manager? Understanding the Benefits and Considerations.

2025 Market Outlook

2024 Recap

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "